E-invoicing is nothing but the digital version of your traditional invoice, which is prepared in a pre-defined format and authenticated by the Goods and Services Tax Network (GSTN). Invoices made through this system are all made in a common format before being reported to the GST portal.

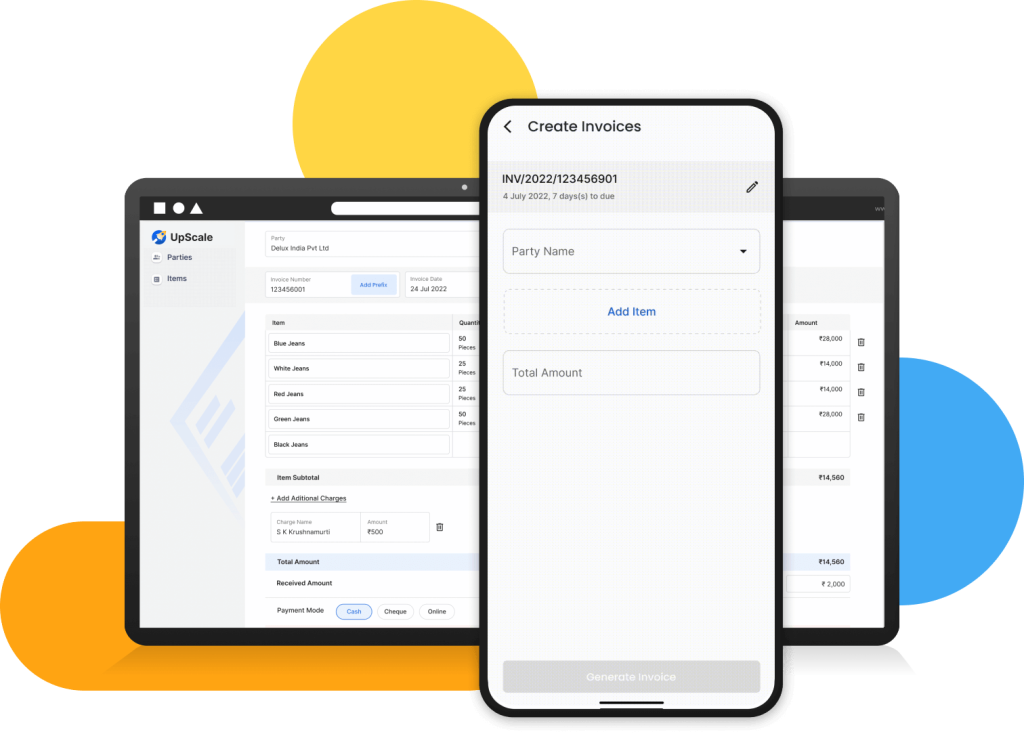

Despite E-Invoicing being made mandatory for businesses with an annual turnover of Rs. 10 crores & above, a lot of businesses still find it to be difficult. That is why at UpScale we’ve worked on a comprehensive e-invoicing solution that helps business owners like you with every single requirement.

In this blog, we discuss everything you need to know about our solution & more. Read on.

Key takeaways

How does e-invoicing work?

Is this a new system?

How is e-invoicing different from regular e-invoicing?

What is the process behind creating an e-invoice?

Why should you choose UpScale’s E-Invoicing solution?

What are the important aspects of UpScale’s e-invoicing solution?

Is your data safe with UpScale?

1. How does e-invoicing work?

Every time a business creates an invoice for their customer, the same needs to be uploaded to the Invoice Registration Portal, or in short, IRP, for validation.

Once it’s validated, a unique number called Invoice Reference Number or IRN and a QR code is issued by the IRP.

An invoice will be considered valid only if it has an IRN and QR code that is authenticated by the IRP (Invoice Registration Portal).

The system makes compliance easier and ensures interoperability between GST ecosystems.

2. Is this a new system?

No, it’s been used by businesses since October 2020. Initially, enterprises with a turnover exceeding INR 500 crore had to create an e-invoice.

The government wanted everyone to get accustomed to the system slowly. Today, businesses with a turnover exceeding 10 crores are required to create e-invoices.

3. How is e-invoicing different from regular e-invoicing?

Tech companies provide invoicing and billing solutions where you can generate invoices digitally, manage your vendors and customers, and manage inventory online.

Upscale invoicing solutions provide all the above facilities along with easy sharing via WhatsApp, email, and SMS.

UpScale Invoicing Solutions is free of cost and provides comprehensive features as per your business need.

Generating an online invoice is not mandatory. However, generating an e-invoice is mandatory (as per the income slab).

For creating an e-invoice, businesses need to generate an IRN (invoice reference number) through the government portal or UpScale. On the other hand, to create an online invoice, one doesn’t have to go through this completely defined process.

Going forward, all other forms of invoices will be considered invalid. Only e-invoices will be considered valid and legal.

It is a government mandate for businesses to file GST with e-invoices only.

4. What is the process behind creating an e-invoice?

As a supplier, you need to first generate your invoice JSON in the prescribed format. For this, you can take the help of ERP software. You can also use the offline utility tool.

Upload the JSON to IRP. When an ERP system is connected to IRP using GSP, the process of uploading the JSON file is streamlined because the system automatically transmits all the pertinent information to the IRP dashboard.

IRP validates the JSON generated by the ERP Software.

Once the verification is done, an IRN is generated. Also, the invoice is digitally signed, and a QR code is added by IRP.

The digitally signed e-invoice JSON along with the QR code will be shared with you. As a supplier, you need to print these details on the invoice. When an ERP system is connected to IRP using GSP, the process of uploading the JSON file is streamlined because the system automatically transmits all the pertinent information to the IRP dashboard.

The E-Way Bill System and the GST System will get the electronic invoice data and IRN once both parties have signed off on them.

The e-invoice system will auto-populate the Part-A of e-way with the JSON data obtained from IRP. If the seller already has the necessary information to create an e-way bill (Part -A and Part-B) and an e-invoice, the e-way bill will be created automatically, and the e-invoice data will include the e-way bill number.

The information in GSTR-1 and GSTR-2A will also be pre-filled by the GST system.

If a buyer wants to verify that a supplier has properly applied ITC to an invoice they have uploaded, they can do so in real-time using GSTR-2A.

5. Why should you choose UpScale’s E-Invoicing Solution?

UpScale’s E-Invoicing Solution makes your life easy. You don’t have to run from pillar to post to create an e-invoice. Follow the below steps to create an e-invoice with UpScale.

- Register your business in the e-invoice portal

- Create API credentials for our partnered GSP-IRIS

- Enter your portal credentials in UpScale

- Upload your invoice to the IRP

- Get validated, signed e-invoices with IRN

6. What are the important aspects of UpScale’s e-invoicing solution?

- Most affordable e-invoicing solution

- Upload unlimited Excel sheet for creating invoices

- Get access to invoices that were created more than 48 hours ago

- UpScale’s e-invoicing solution works with all types of ERPs

- Helps you get started in just under 15 minutes

- Convert your existing invoices to e-invoices

And you can do all of this at the most affordable pricing. That brings us to –

Our Pricing

UpScale offers the most affordable e-invoicing solution. What’s more exciting is that you get our feature-loaded payables & receivables module absolutely free. For more information, sign up for a free demo with us from here.

7. Is your data safe with UpScale?

Your data is absolutely safe with UpScale. We are ISO 27001:2013 certified and compliant with all government mandates which makes us 100% secure. Our business is approved by the Reserve Bank of India. That is why we take the utmost care of your data privacy.

Conclusion

We hope our blog was able to resolve all queries you may have regarding our E-Invoicing solution. If you have any further doubts, do let us know in the comments section below.