Financial inclusion plays a crucial role in fostering the growth and development of Micro, Small, and Medium Enterprises (MSMEs) in India.

The role of MSMEs in India’s economy

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of the Indian economy, making a substantial contribution to its growth and development. These enterprises play a vital role in generating employment, fostering innovation, and driving inclusive economic growth.

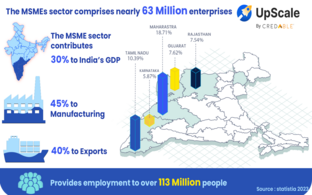

The MSME sector possesses immense potential to fuel the country’s economic growth by leaps and bounds, accounting for a substantial 30% contribution to the GDP.

The MSME sector comprises nearly 63 million enterprises, which contribute 30 per cent to India’s GDP, 45 per cent to manufacturing, 40 per cent to exports, and provides employment to over 113 million people, per government data

In February 2023, the state of Maharashtra accounted for 18.71 percent of the medium, small, and micro enterprises (MSMEs) in India, making it the largest contributor. Tamil Nadu followed closely with a share of over 10 percent. The Ministry of Micro, Small, and Medium Enterprises (MSMEs) has implemented several schemes aimed at providing credit and financial assistance to MSMEs across the country. Additionally, the central government has initiated specific schemes that target the northeastern states of India, further supporting the growth and development of MSMEs in those regions.

Lack of funding: the perennial MSME challenge

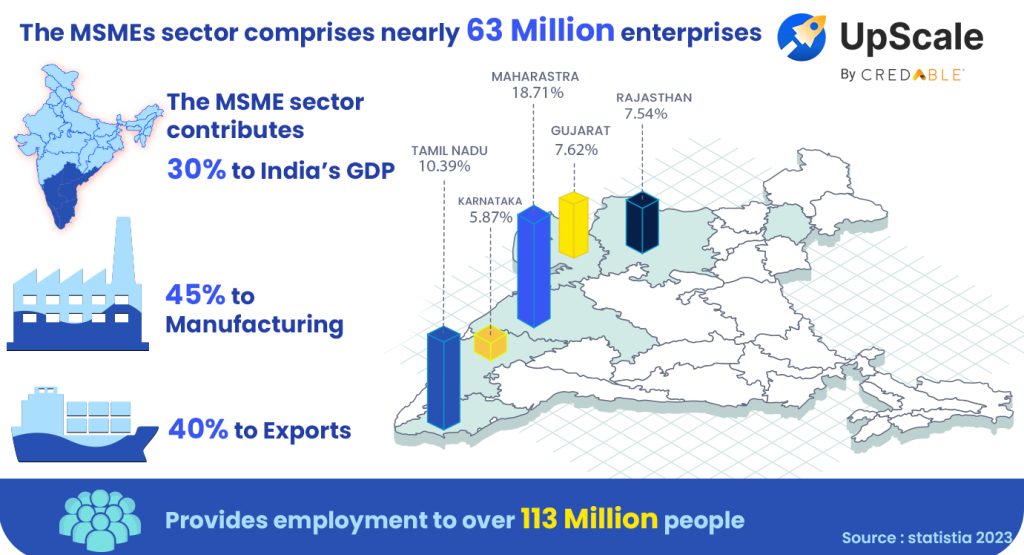

According to a study released by Avendus Capital, the MSME lending landscape reveals a staggering credit gap of $ 530 billion, despite the Y-o-Y credit growth.

With the advent of digital lending, the landscape of financial services has witnessed a paradigm shift, offering immense opportunities for MSMEs to access much-needed capital and propel their businesses forward.

Role of alternate lenders

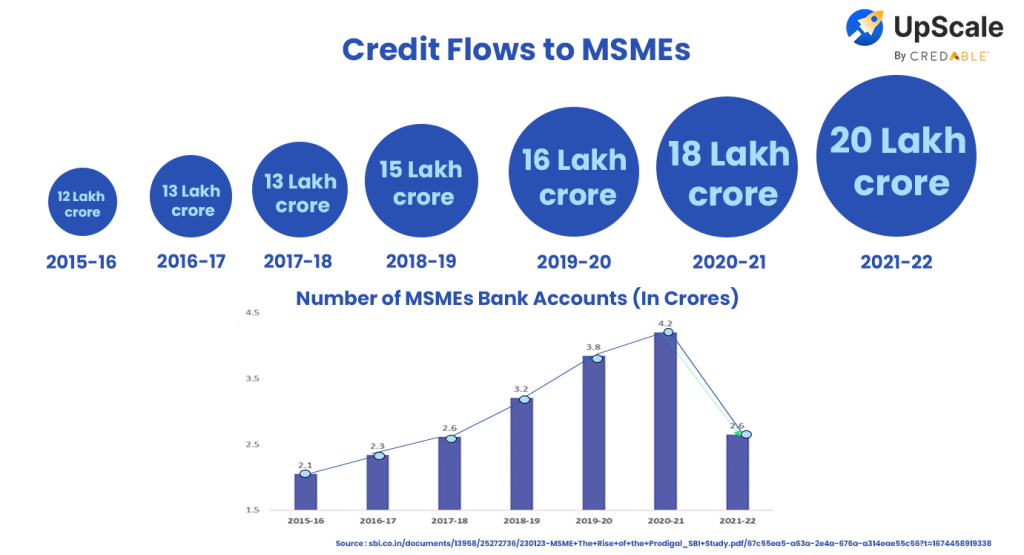

Despite the significant credit gap, there is a positive outlook for small-ticket MSME non-banking financial companies (NBFCs). These NBFCs are expected to expand their branch networks aggressively in order to reach new customers across India. According to a report, the small-size loan segment is projected to grow by 23%, increasing from an estimated $ 25 billion in FY22 to $ 38 billion in FY24.

This growth can be attributed to the well-established branch networks of nimble NBFCs, which have a strong presence in urban, semi-urban, and rural areas. Furthermore, their success is also attributed to their proprietary underwriting processes, tailored technology solutions, and customer-centric approach.

Opportunity for alternate lenders in the MSME landscape

Small ticket MSME NBFCs have a promising opportunity on the horizon. According to Avendus Capital’s report, these NBFCs are projected to witness a remarkable tenfold surge in deal flow, reaching approximately $15 billion in the coming decade. As the Indian economy gears up for rapid growth, a vast untapped market awaits these NBFCs. This presents an exceptional chance for them to cater to the underserved segments and propel their own expansion.

By capitalizing on this favorable climate, small ticket MSME NBFCs can unlock substantial potential, capitalizing on the rising demand for financial services in the MSME sector. The envisioned growth trajectory of the Indian economy serves as a fertile ground for these NBFCs to thrive, seize opportunities, and contribute significantly to the nation’s economic advancement.